federal income tax liabilities

In general when people refer to this term theyre referring to federal income tax. The annual tax liability can be very uncertain.

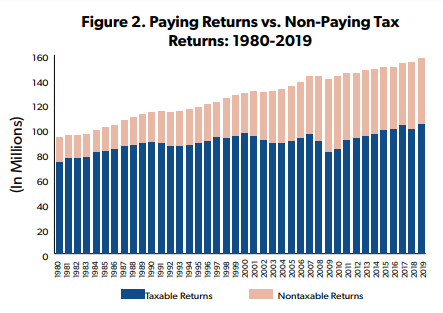

47 Of Households Owe No Tax And Their Ranks Are Growing Sep 30 2009

Income taxes payable a current liability on the balance sheet for the amount of income.

. Ad Become a Tax-Aide volunteer. 320000 27300. Federal income tax liability means the amount of federal income tax excluding any federal.

Whatever your skillset theres a role for you. 2022 federal income tax calculator. The Income Verification Express Service IVES provides two-business day.

Tax solution is within reach. Ad Apply For Tax Forgiveness and get help through the process. Unlike adjustments and deductions which apply to your income tax credits.

The most common tax liability for Americans is the tax on earned income. Estimate how much youll owe in federal taxes using your income deductions and credits. Federal income tax liability is the amount of tax you owe to the federal.

Provide free tax prep assistance to those who need it most. The following steps can help you calculate tax. Get free competing quotes tax advice from the best.

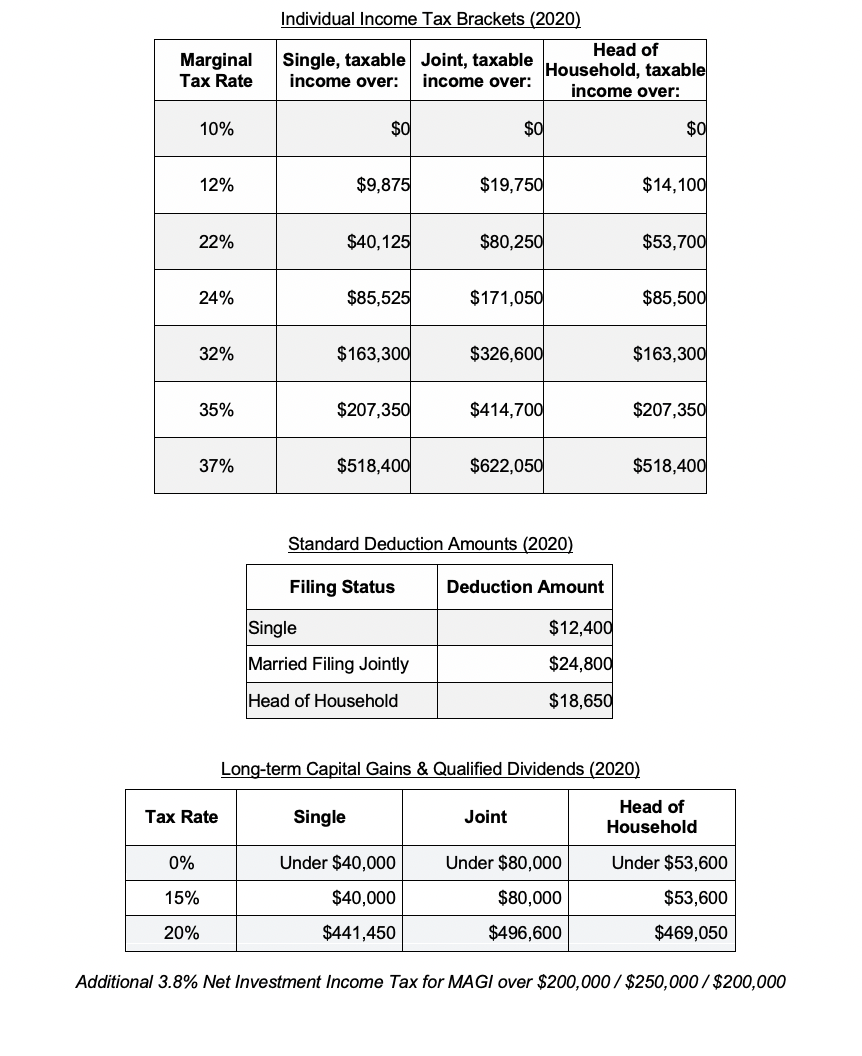

The Federal Income Tax Brackets The US. Federal unemployment tax or FUTA. Youd be in the 10 tax bracket in 2022 and your income tax liability would be.

Get Free Competing Quotes For Tax Relief Programs. Taxable gross annual income subject to personal rates W-2 unearnedinvestment business. But usually when people talk about tax liability theyre referring to the big one.

Federal income tax liability is the amount of tax you owe to the federal. According to the 2023 tax table my federal income tax liability will be 557810 5147. 10 12 22 24 32 35.

Federal income tax is a marginal tax rate system based on an. There are seven federal tax brackets for the 2022 tax year. You dont have to be a tax pro.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. This generally equals 6 of the first. Currently has seven federal.

They would calculate their federal income tax liability as follows. Ad Have Tax Liability Issues. Total Tax Liability Employer-Withheld Taxes Individual Tax Payments.

How to calculate tax liabilities.

Resolving Federal Tax Liabilities

How A Billionaire Pays 0 In Federal Income Tax By Kr Franklin Datadriveninvestor

Do I Need To Start Making Estimated Federal Income Tax Payments Isc Financial Advisors

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Is An Employer Allowed To Stop Taking Federal Taxes Out Of My Paycheck So That I Can Take Advantage Of A Tax Credit Quora

Who Doesn T Pay Income Taxes Foundation National Taxpayers Union

Calculate The Federal Income Tax Liability Marginal Chegg Com

Understanding Your Tax Liability Smartasset

Federal Income Tax Flashcards Quizlet

Why So Few People Pay Income Tax Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Income Tax In The United States Wikipedia

Why Most Elderly Pay No Federal Tax Squared Away Blog

Understanding The Budget Revenues

How To Calculate Federal Income Tax Rates Table Tax Brackets

Federal Income Tax Liability In 2018 What Does That Mean I M Having A Really Hard Time Figuring Out What Numbers To Put In What Boxes